By Edward Layne

The recent International Monetary Fund (IMF) mission which visited Guyana for the Article IV Consultation has cautioned the APNU/AFC Government over the growing number of non-performing loans, the increase in public expenditure and the need for moderating the growth of public sector wages.

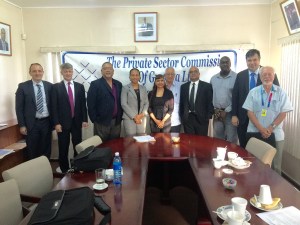

This warning came after an IMF mission, led by Marcos Chamon, was in Guyana between February 24 and March 7, 2016, for discussions with authorities on the 2016 Article IV Consultation.

The team met with Finance Minister Winston Jordan, Public Infrastructure Minister David Patterson, Natural Resources Minister Raphael Trotman, Central Bank Governor Gobind Ganga, Opposition Leader, Bharrat Jagdeo, representatives from the private sector, labour unions, and other stakeholders.

“Banks remain well capitalised, but heightened vigilance is warranted due to increases in nonperforming loans,” the IMF said in a statement on its website.

The IMF said it also welcomes the recent changes to credit reporting legislation and the authorities are encouraged to continue to strengthen financial sector supervision.

It said the mission suggested tightening, provisioning requirements; large exposure limits restrictions on related lending; and loan classification rules.

“In addition, the stress testing toolkit could be expanded to include shocks to loan collateral values and also take into account inter-linkages among economic sectors, borrowers, and financial entities,” it stated.

A Financial Sector Assessment Programme mission from the IMF will visit Guyana in May to provide “a more granular analysis of financial sector challenges” and assist with strengthening the prudential toolkit.

Original warning

Shadow Opposition Finance Minister, Irfaan Ali in November 2015 warned that hundreds of Guyanese, many of them businessmen were on the verge of losing their properties as a result of inability to pay their mortgages, as the local economy continued to flounder.

Ali said based on data in his possession of his own investigations from many financial institutions, non-performing loans or loans where the borrower failed to pay instalment for three months, have increased by 69.7 per cent in 2015 and continues to skyrocket.

Meanwhile, the IMF warned that the increasing current expenditure of the government will crowd out space for public investment, despite significant donor support.

“The mission suggested moderating the growth of wages, as well as reforming public enterprises with a view to reduce their reliance on government support…Containing current expenditure would provide additional space for public investment while preserving debt sustainability,” the mission warned.

Economic growth

It said while the improved financial performance of Guyana Power and Light and the reforms proposed by the Commission of Inquiry for the Guyana Sugar Corporation are welcomed, the scope and pace of reform should take into account social implications.

The IMF said the Guyanese economy remains resilient and continues to grow despite significant global headwinds. The government of Guyana projects 4.4 per cent growth in 2016, but the IMF said it is likely to grow by 4.0 per cent.

What have they done to raise $300M absolutely nothing,is money that was there from the former govt.

When reality hits as such…the next step will be to conserve by squeezing the nation as if they cause it upon themselves… the cycle is all happening again.

Why this problem happening again?

Is it because we as a nation wasteful, unproductive, incompetent leadership, fail to build a manufacture sector, fail to acquire technology through import substitution policy, fail to attract foreign direct investment, brain drain challenge, corruption, bad negotiation, people living too luxurious, population too small to payback, crime ratio to population too high, we like to party/celebrate and work less, too much pressure/demands/control from froeign source, too much help from foreign source, bad investment, the previous government thief too much, etc? Will we end up again with economic rating as a poor impoverish nation?

Why I am asking, is because our late President LFS Burnham didn’t understand the reasons as well too…

Despite their cries that the PPP govt left no money, the PNC govt has found a lot of money to squander on celebrations. It is still inconceivable that they can spend $300Million on 50th Anniversary celebration yet cannot give any raises to the Public Sector, even after taking hefty raises for themselves BEFORE they even turned a straw. They are slowly? but surely driving the economy into the ground and a position where the currency will be devalued further. Good Ole PNC at work? again.

IMF warns Granger’s Govt over non-performing loans, spending spree.

You have to give PNC credit for what PNC does best and that is to throw a big mighty huge humongous bash wtih TAXPAYERS MONEY of course.

When PNC people has to pay for their bash they lime on one beer all night long on the prowl hoping to score another babe.

Guyanese and IMF will see PNC greatest jump up yet to come for Guyana’s 50th.

PNC will tell Guyanese and IMF people that its private Guyanese citizens footing their jump up bill and not taxpayers.

PNC told IMF 4.4% economic growth for 0-16 and IMF give them a by and say 4%.

Well the IMF people have nothing to fear since America oil giant if there ready willing and able to pass over a few billions in advance to PNC before oil starts to gush. Inews must keep tabs on PNC 4% economic growth for -0-16.

I am starting to laff already lol